This post has been updated on December 16, 2024 because of our terrible interaction with Revolut’s customer support, which has lost me almost 600 euro.

Revolut is a neobank based out of Canary Wharf, UK. At the moment of writing this review, Revolut has more than 45 million users worldwide—especially people who travel a lot and use Revolut as a convenient bank account that can be used worldwide. I have been using Revolut since 2019, and I have been using it as my primary bank account since 2022. This is an honest review of my experience with Revolut.

Disclaimer: Neither I nor Road to the Uknown is affiliated with, endorsed, or sponsored by Revolut.

The updated overall score of Revolut Ultra Plan after my terrible interaction

You can find it here if you are not in the mood to read the whole review but want a quick overview. However, some of the points in this review might need more explanation, so we recommend reading it.

Updated overall score of Revolut Ultra Plan Review

- Ease of use: 8 out of 10

- Customer service: 1 out of 10

- Costs: 1 out of 10

- Perks: 1 out of 10

- User-friendly: 1 out of 10

- Investing: 9 out of 10

- For traveling: 8 out of 10

- Overall score: 29 out of 70, or bad!

Before our terrible experience with Revolut as a Revolut Ultra user, we were very happy bank customers. However, we pay for Ultra and should receive priority customer support.

Besides that, almost $60 per month for a bank account should give you some perks. However, our bad experience with Revolut clearly showed the limitations of an Internet bank.

Although Revolut is a handy bank for travelers, it is nowhere near as professional as a traditional bank, and you can see it in some of its services. We recommend different online banks such as Bunq, Monzo as N26, or a conventional bank.

Interaction with Revolut Ultra led to the update of this review – we lost $600

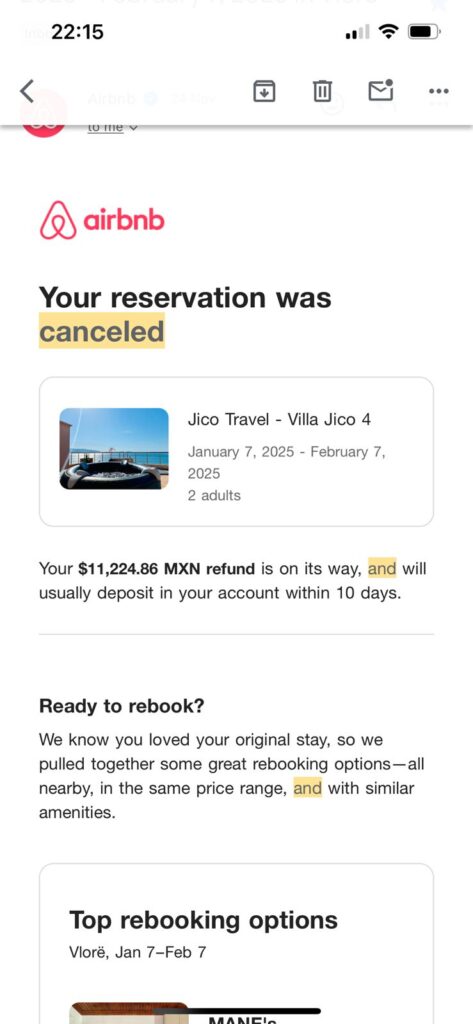

A month ago, one of the Airbnbs we booked in Tirana suddenly canceled. After contacting Airbnb, they told us that Revolut was holding the money. They even gave us a code that was supposed to release the money.

the cancellation email from Airbnb

Of course, we messaged Revolut’s customer support after spending almost $600 on an Airbnb we didn’t get. The only thing they said was that they couldn’t do anything with the code. They told us that we needed to file a dispute.

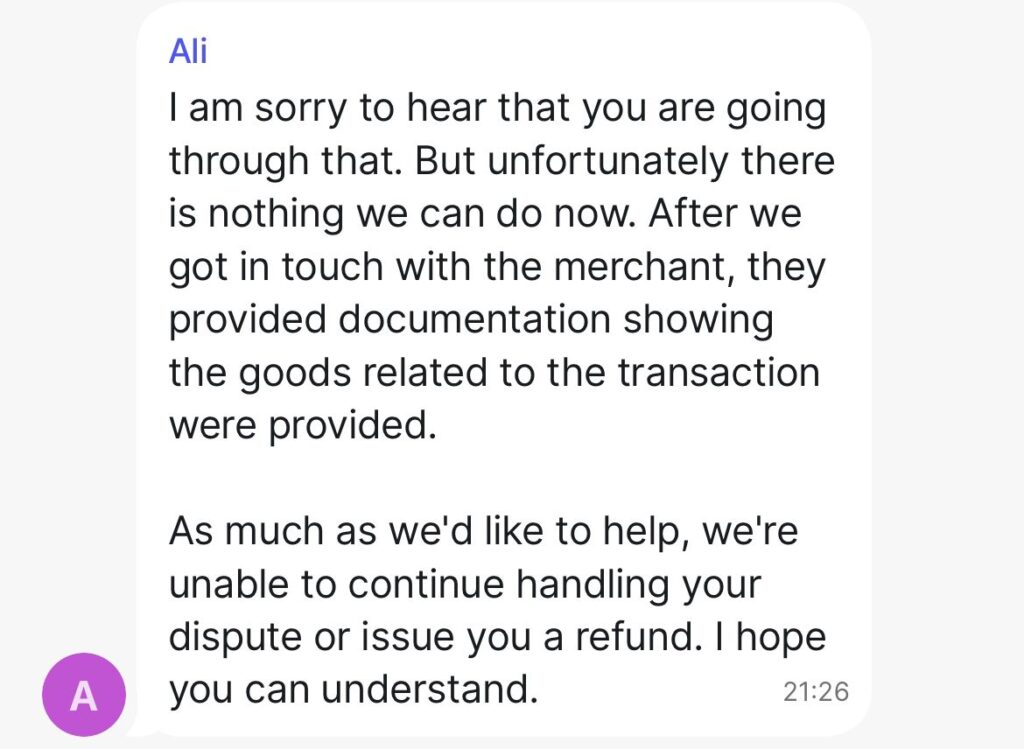

We filed a dispute, which was rejected in less than two days. In our dispute request, we added multiple emails, proof, and screenshots where Airbnb told us that we should have got the money refunded. Airbnb claimed that they had delivered the service we paid for.

We had loads of proof that we didn’t receive anything, so we thought we could message customer support. However, Revolut customer support was so unhelpful and unwilling to find a solution that we felt robbed. They were not even trying to help us. They only said to us that the dispute had already been decided. Eventually, we just took the loss after Revolut didn’t help us.

However, this shows why you shouldn’t rely on a bank like Revolut. Any normal bank would try to help you as a customer, especially if you are part of their highest plan. Revolut provided the most unhelpful customer support we had ever received. Their unwillingness to help after we lost $600 is the reason for the update of this Revolut Ultra review.

What is Revolut

Revolut can be described as an internet bank or a neobank. This means the bank has no physical locations and can only be used as a mobile app. They have no office you can walk into, and they focus on a customer segment that mostly travels or spends loads of time abroad. You can also see this in the perks they offer users, which we will discuss later.

What is Revolut Ultra

Revolut has multiple plans; the highest is Ultra, and you pay around $60 or €55 per month for this plan. This might seem like quite a lot of money, but you also get many perks you can use while traveling the world. These perks include using WeWork offices, unlimited airport lounge access, discounts for a second person who travels with you, and a NordVPN subscription. Furthermore, you also get monthly eSIM data if you use Revolut Ultra.

Why would you need Revolut Ultra?

I use Revolut Ultra because I travel often and have lived primarily in foreign countries. It can sometimes be hard to open a bank in these countries, especially if you don’t have residency in a particular country.

But other perks could benefit you from Revolut Ultra. Travelers can use Revolut Ultra to book stays, get special discounts, access airport lounges, or spend miles on flight tickets.

Another reason people choose the Ultra plan is because it does not charge fees for sending money abroad. When you have family living in other countries, using services such as Western Union might get expensive. The Ultra Plan doesn’t have these fees.

Revolut Ultra banking review

We really loved the bank. The bank was one of the most accessible banks I have ever had the pleasure of using. However, since one of the latest updates and all the extra perks you get by using Revolut Ultra, it can sometimes be hard to find everything in the application.

Stocks

If you are into investing, this bank can also be an excellent option. Using the stocks option on your Revolut is relatively easy. You need to type in stocks in the search bar and click on the “brokerage account” option. You can also use the brokerage account to add recurring payments to a particular stock or bond. I have used this myself, and for someone who is not that much into investing, it feels easy and very user-friendly. With the Revolut Ultra plan, you can get up to 10 commission-free stock purchases.

Crypto

If you are a “crypto-bro,” Revolut Ultra can also be helpful. The mobile app also has a crypto trading platform that you can use to buy more than 100 different cryptocurrencies. Whether you want to buy a leading crypto like Bitcoin or a more alternative option like Pepe. Revolut Ultra has many options for people wanting to make their first crypto purchase or have been trading crypto longer.

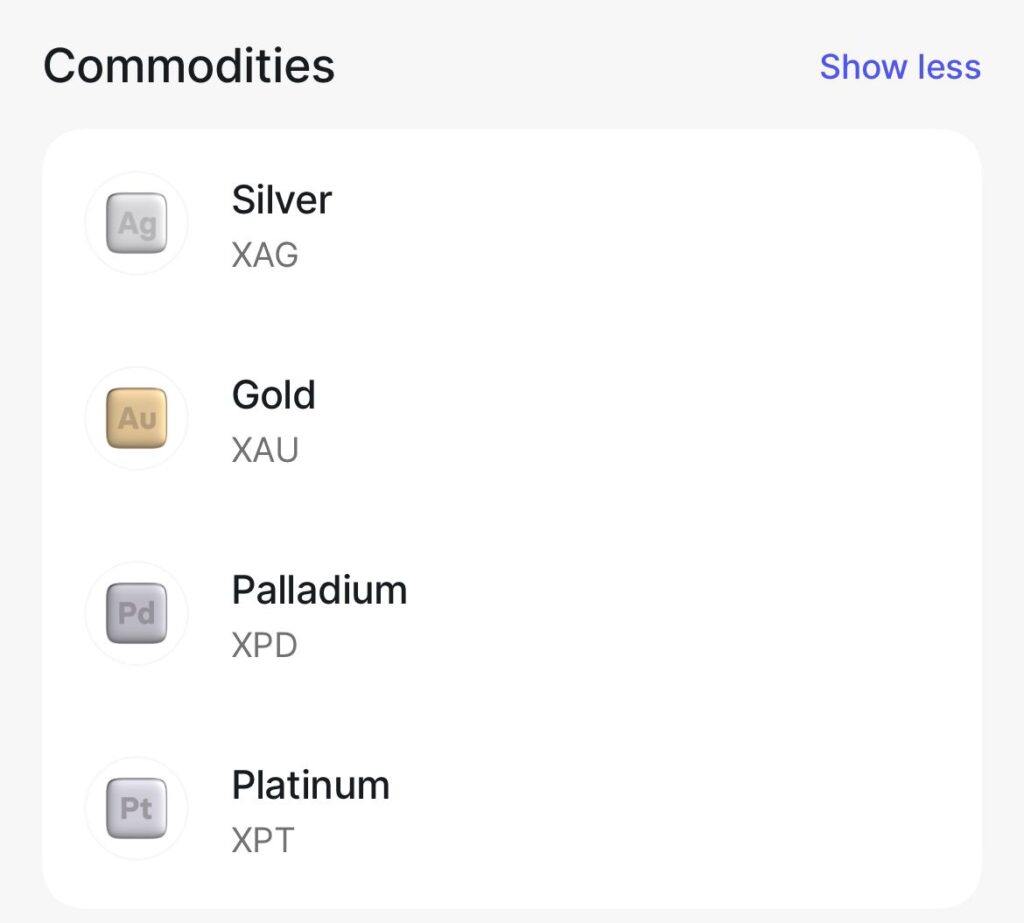

Commodities

If you want to invest more traditionally, Revolut Ultra has options. Trading general commodities is relatively easy: Type in commodities in the search bar, and Gold, Silver, Palladium, and Platinum will appear.

Saving

Another great function of the Revolut app and Ultra subscription is the ability to save money on the account. Although most banks offer some savings accounts, Revolut goes one step further. You can save money in multiple ways.

For example, you can set it up on an annual yield account in US dollars and euros or on a separate page and give it a name. As you can see below, mine is called “engagement ring,” so I could save up for an engagement ring for Letisha. Luckily, I bought the engagement ring and am taking the money off this separate account. Another option is to send a percentage of every money spent into this separate account and then use it when you need to top up your balance.

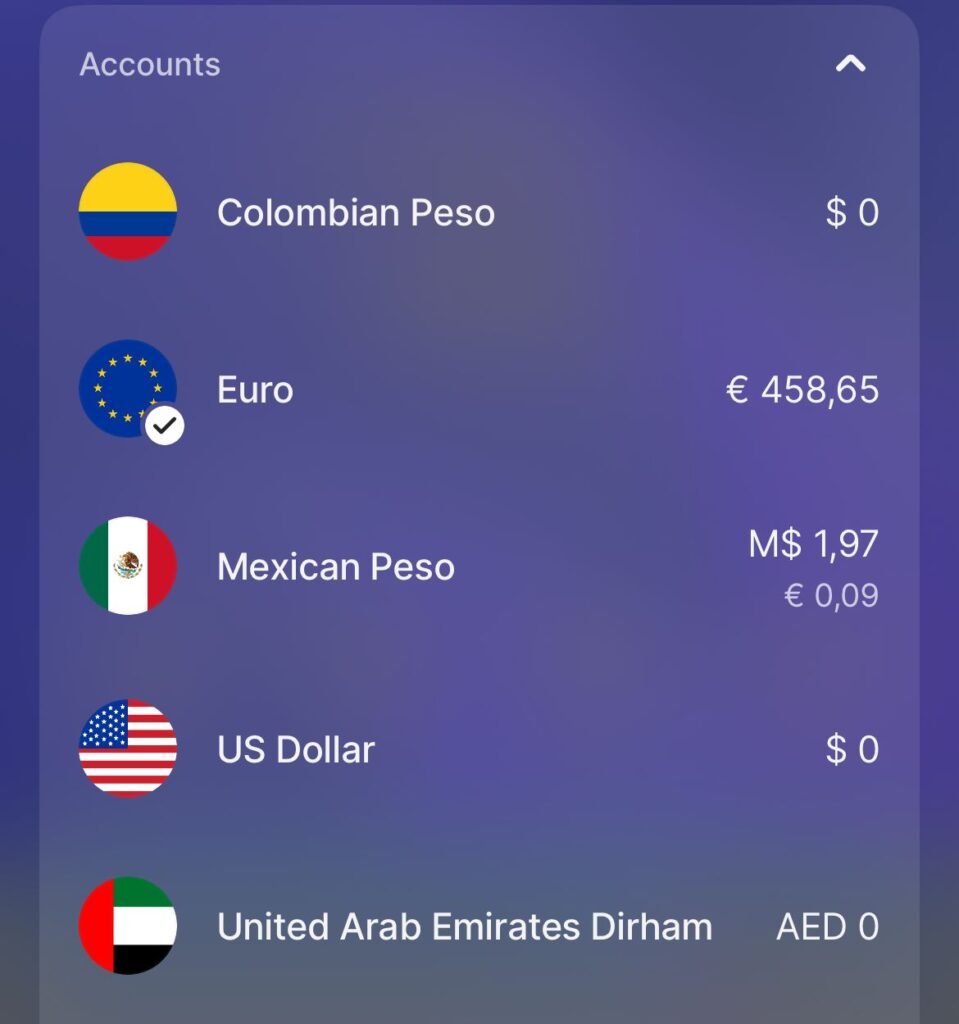

Currency exchange review

Another good reason to choose Revolut Ultra is the currency exchange. This is one of the features that Revolut has that almost no other bank has, and I use it a lot. When Letisha and I were still in Mexico, I would transfer my income directly into Mexican Pesos, and now we are in Albania. I transfer my euros into Albanian Lek. This makes it easier to get an overview of how much you spend and how much things cost in a country. It also makes seeing how much you take out with your Revolut card worldwide easier.

Revolut Ultra cash withdrawal review

You might want to take out some cash when spending a lot of time abroad. After all, in some countries, cash is still widely accepted, and there are even a lot of places that don’t accept cards. This is one of the best features that Revolut has, in my opinion, as you can take cash out easily in multiple places around the world. With Revolut Ultra, you can take up to €2000, or $2000, without paying Revolut a commission fee. However, you must be careful, as many banks in foreign countries charge a commission. This is the commission that the local bank charges, but at least you are not paying double commission with Revolut Ultra.

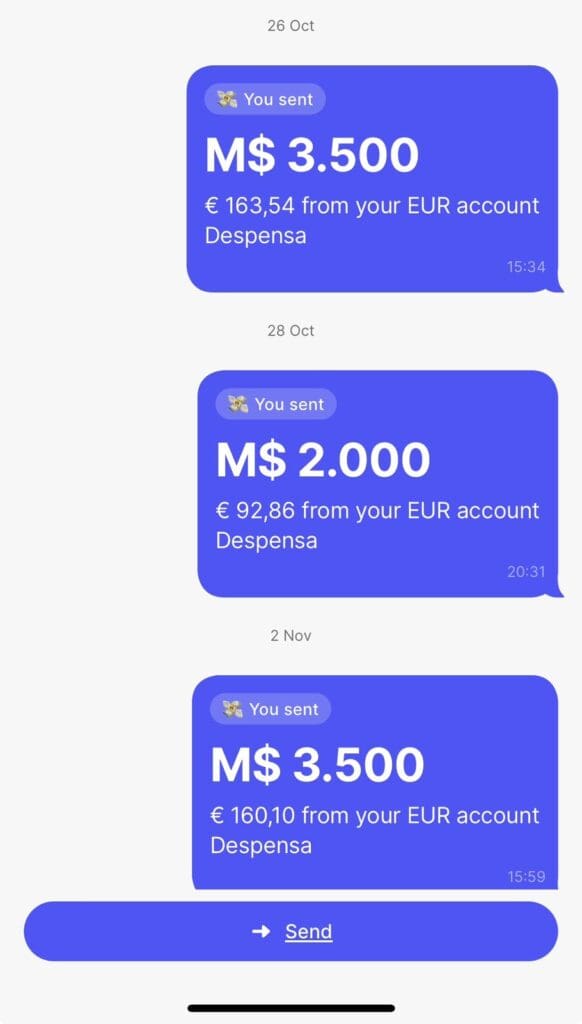

Worldwide transfers with Revolut review

Another great function of Revolut Bank, which I often use, is its worldwide transfer feature. It makes it very easy to send money to foreign bank accounts. Sometimes, I need to transfer some money to Letisha, and this is the feature I use. Worldwide transfers allow you to transfer to more than 160 countries and pay low fees and quite advantageous currency exchange. It also makes it easier to transfer abroad because Revolut is a modern bank; finding the correct details for making a transfer is pretty straightforward. In some cases, getting a CLABE or an IBAN can be pretty tricky. With Revolut, we never had any trouble sending money to each other.

Revolut Ultra subscriptions review

A lot of the benefits that Revolut Ultra has to offer come with the subscriptions you get when getting this plan. Some are more useful than the other, but you get a lot more than what you are paying for. These are some of the subscriptions that are most useful to me. Just remember that where your Revolut Bank account subscription is located can make a difference in the subscriptions you receive. My bank account is registered in Spain, and these are some of the subscriptions that Revolut has given me. It is, therefore, essential to check what subscriptions you get if this is one of the main things that have drawn you to Revolut.

NordVPN

This is my favorite subscription that comes with the Revolut Ultra. Traveling a lot can sometimes make you miss your home country, so having a reliable VPN helps with homesickness. I would say this is the subscription I make use of the most.

WeWork

WeWork is a feature I haven’t used personally, as I thought the company was already bankrupt. However, I do use a lot of coworking spaces when we travel, and WeWork has excellent locations throughout the world. Unfortunately, the Ultra Plan only comes with three monthly credits that you can use for a WeWork desk.

ClassPass

Another great benefit of using Revolut Utlra that we haven’t mentioned in this Revolut Ultra Plan review is that you get up to 20 credits each month for ClassPass. This is an excellent benefit for people who travel and don’t want to sign up for gyms. Unfortunately, ClassPass is usually only available in bigger cities, so if you like to travel off-grid or to smaller cities and towns, this might not be that handy.

MasterClass

If you are often on the road, it is nice to invest in your self-development. This is especially true if you are a freelancer or own a business, which I know many people who read our blog are. With the MasterClass subscription added to the Revolut Ultra Plan, you can enjoy unlimited access to 180+ classes and instructors. From Gordon Ramsey to Neil Degrasse-Tyson, this app has something for everyone.

Chess.com

The resurgence in playing chess because of Twitch’s streaming platform has not gone unnoticed, nor at Revolut Ultra. Revolut Ultra allows you to get a Chess.com Diamond subscription without paying extra. You can use the website to play against 150 million people worldwide online. Although I have never used this feature, I am not that into chess, but I know many people are.

The Athletic

The Athletic is a sports news app that approaches writing news stories differently from most news apps. The application has general news like you could see on any other sports news website. However, it also has more in-depth articles written in an engaging and fun way. It is recommended for people who like sports.

Financial Times

This is for people who want to improve their financial literacy. The Financial Times application is from one of the world’s most renowned financial newspapers. If you need to improve your financial skills, this is the application you want.

Headspace

When you are on the road, you might forget to take time and work on your mental health and mindfulness. No worries; Revolut Ultra comes with Headspace, an application that offers mindset courses, mindfulness exercises, and guided meditation.

Sleep Cycle Premium

Another application that can help you with your mental health is Sleep Cycle Premium. This app has an intelligent alarm clock and tracks your sleep, so you don’t have to do it. This is one of the applications I haven’t used that much, as the iPhone has a sleep tracker built in. Although this app gives a bit more details, it generally doesn’t differ much from Apple’s sleep tracker.

Freeletics Coach

If you would rather train from the comfort of your Airbnb than go to the gym, Revolut Ultra offers a fantastic feature. This Freeletics Coach app has an AI-powered personal trainer that allows you to make amazing workout plans. Although I haven’t used the app yet, this is one of the ones I am most curious about.

Tinder Gold

Of course, I haven’t tried this out and will never. However, if you travel a lot and have difficulties connecting with people, Tinder Gold can be an excellent solution for finding friends and dates abroad. Tinder Gold also allows you to switch locations to start matching before going to the next area.

Picsart Gold

I have used this application a couple of times, and although it is ok, it is nothing compared to Canva or many other photo editing apps. I am not the biggest fan of Picsart Gold, but it can be nice to edit your travel pictures. Instead, we use a combination of Lightroom and Canva on our Road to the Unknown and personal social media.

Headway Premium

Another application for self-development is Headway Premium. This Application gives you nonfiction bestsellers in 15-minute reads, audio, summaries, and more. I have used this application several times, but it is not as good as similar apps that let you do the same, such as Blinkist.

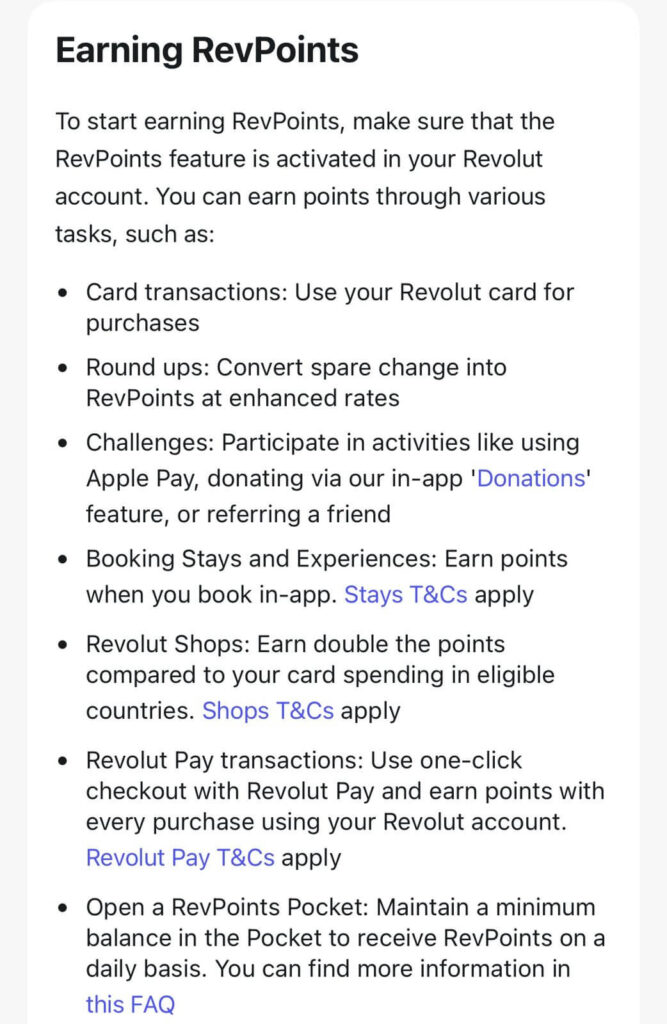

Revolut Ultra points review

Of course, we can not forget about Revolut Ultra points in this review. Revolut points, or RevPoints, allow you to pay for experiences in shops or donate to charities. Some people love this feature, and some people don’t. I don’t like or dislike this feature in my Revolut; it is just there. This is because I haven’t used the feature that often. Furthermore, the deals you get on stays are not great, although we used them during our stay at the Marriott in Tirana.

Shops

The Revolut online shops function allows you to buy stuff from various websites. Some websites where you can buy things online are Lenovo, Nike, Oakley, and even the North Face. This sounds great, but we are looking at Revolut from a travel perspective. Since my bank account is registered in Spain, I can only get things at a discount from the Spanish website. As a traveler, I find this far from ideal. Luckily, there are also some online products that you can buy at the Revolut shops, such as McAfee, Norton, and Private Internet Access. When buying at these shops, you get better deals on RevPoints; at some places, you can even get 10 or 20 percent off.

Donations

Donations are also a function of Revolut Ultra, which I have barely used. This is not because I wouldn’t say I like giving money to charity but because I mostly donate in other ways, such as through a charity’s website or a GoFundMe. However, the donations feature makes tracking your monthly donations to charity easier.

Revolut Ultra travel review

We have come to the most essential part of this review for most of our readers. Is this the banking app best for people who travel a lot? I would say yes, but let me tell you why and which things can be done better.

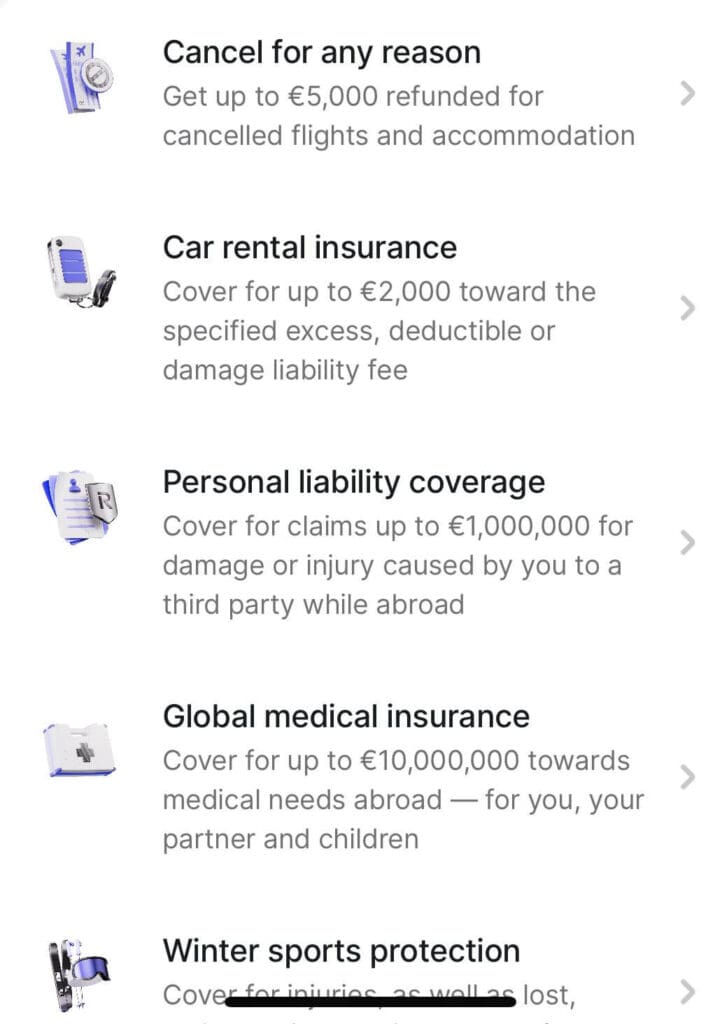

Revolut Ultra travel insurance review

I must say, I haven’t used travel insurance that much. However, you do get a lot with the Ultra Plan from Revolut. You get up to a $5000 refund for canceled flights and accommodation and $2000 as a damage liability fee for your car rental. Furthermore, you also get personal liability for up to $1,000,000 for injury caused by you or another party. Revolut Ultra also has global medical insurance of up to $10,000,000 for medical needs abroad.

Last but not least, Revolut Ultra’s travel insurance also covers winter sports injuries, luggage, and flight insurance. I wouldn’t say I like the Revolut travel insurance that much because it takes a lot of time and extra steps to get reimbursement from Revolut Ultra. This can make it difficult when you have an actual medical emergency. However, this is quite normal when trying to get a reimbursement from your insurance provider.

Airport lounges

This is one of my favorite features that Revolut Ultra has to offer. We often use the airport lounge when traveling through different places by plane. Some are nicer than others, but it is generally an excellent option for going to the airport or having a long layover. All the airport lounges that Letisha and I have been to give you a fantastic buffet and a nice seating area. This can not be said of all airport restaurants. Another reason why I like this feature so much is because it gives a significant discount for a second traveler. The discount can even be up to 50%.

Miles

Miles can be traded into flight tickets from different airlines. I know the feature is in the application, but I haven’t used it much. However, you can transfer RevPoints to Miles and then use them to fly Iberia, Vueling, Aeromexico, AirBaltic, China Airlines, Delta Airlines, Etihad Airways, KLM, Transavia, Virgin Atlantic, and about 15 other airlines.

Stays

A feature I have used contrary to miles is “stays.” Stays allow you to book directly through your Revolut Ultra account. You can book stays at many hotels worldwide and use RevPoints, which you can redeem for a hefty discount. As you get a point per every dollar, euro, or pound spent, you usually don’t notice how many RevPoints you have. I used “stays” to book nights at the Marriott in Tirana and the NH collection in Bógota. However, the prices used through stays are higher than those on a Booking Genius Level 3 account. But on Booking, you can not use your RevPoints, of course.

Experiences

Experiences are another option on your Revolut Ultra Plan. Revolut Experiences are very similar to Airbnb experiences. I haven’t used this feature yet, but there are many to choose from. For example, you can go on a bike tour in Seville or a tour of the Blue Eye in Saranda. You can also see the reviews of other Revolut Ultra users directly in the application.

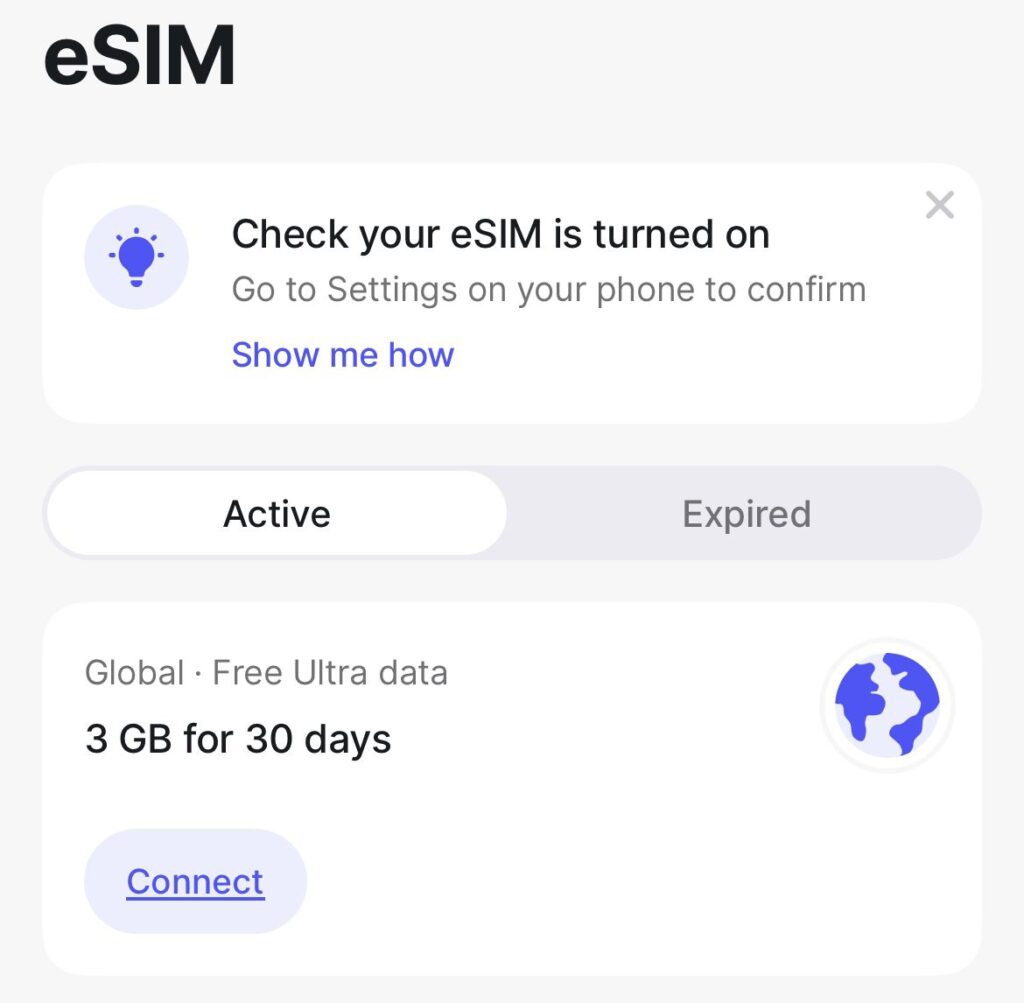

eSIM

The eSIM is a fantastic feature I could not forget in this Revolut Ultra Review. An eSIM is a digital SIM card that lets you connect your mobile phone wherever you are. This is an excellent feature if you travel a lot through different countries and don’t want to get a new SIM card everywhere. However, it is also a great option when you have just arrived in a new country and don’t want to get a local SIM card. You could also use it when you just come off the plane and want to book your transport to the hotel without getting an outrageous phone bill. Revolut Ultra has a standard 3 GB of monthly data for its global SIM card. However, you can also pay for data in a specific country for more than 108 countries.

Revolut Ultra customer support review

Last but not least, the customer support review is included in this Revolut Ultra review. Their customer support can help you with small issues quickly. But when you need them to do anything that a normal credit card would do. They can not do it, such as payment disputes. The only thing they say is that they can not help you anymore. Even when you send them proof that you didn’t receive the service, like us, when we were supposed to get a refund from Airbnb.

Conclusion: Is Revolut Ultra the best option for travelers? (Updated)

At first glance, Revolut seems like an amazing app. However, this is not the case. Because they are not regulated like a real bank, there are a lot of complaints. Also from us. Never put a lot of money on a Revolut card or pay hefty amounts with this bank account. If something goes wrong, their support is almost non-existent. Don’t lose $600 like we did.

Sources:

- https://www.investopedia.com/terms/c/commodity.asp

- https://www.revolut.com/

- https://ascendex.com/en/discover/education/what-is-a-crypto-bro/

- https://ffnews.com/newsarticle/revolut-introduces-latest-version-9-0-of-its-mobile-app-for-ios-and-android-users/

- https://www.remitfinder.com/blog/what-is-a-clabe-number-and-what-is-it-used-for

- https://www.investopedia.com/terms/i/iban.asp

- https://www.reuters.com/legal/wework-cleared-exit-bankruptcy-slash-4-billion-debt-court-says-2024-05-30/

Remember that we might receive a small commission if you book something through our links. However, this does not influence your payment, nor does it affect how we review places. Read more in our affiliate policy.